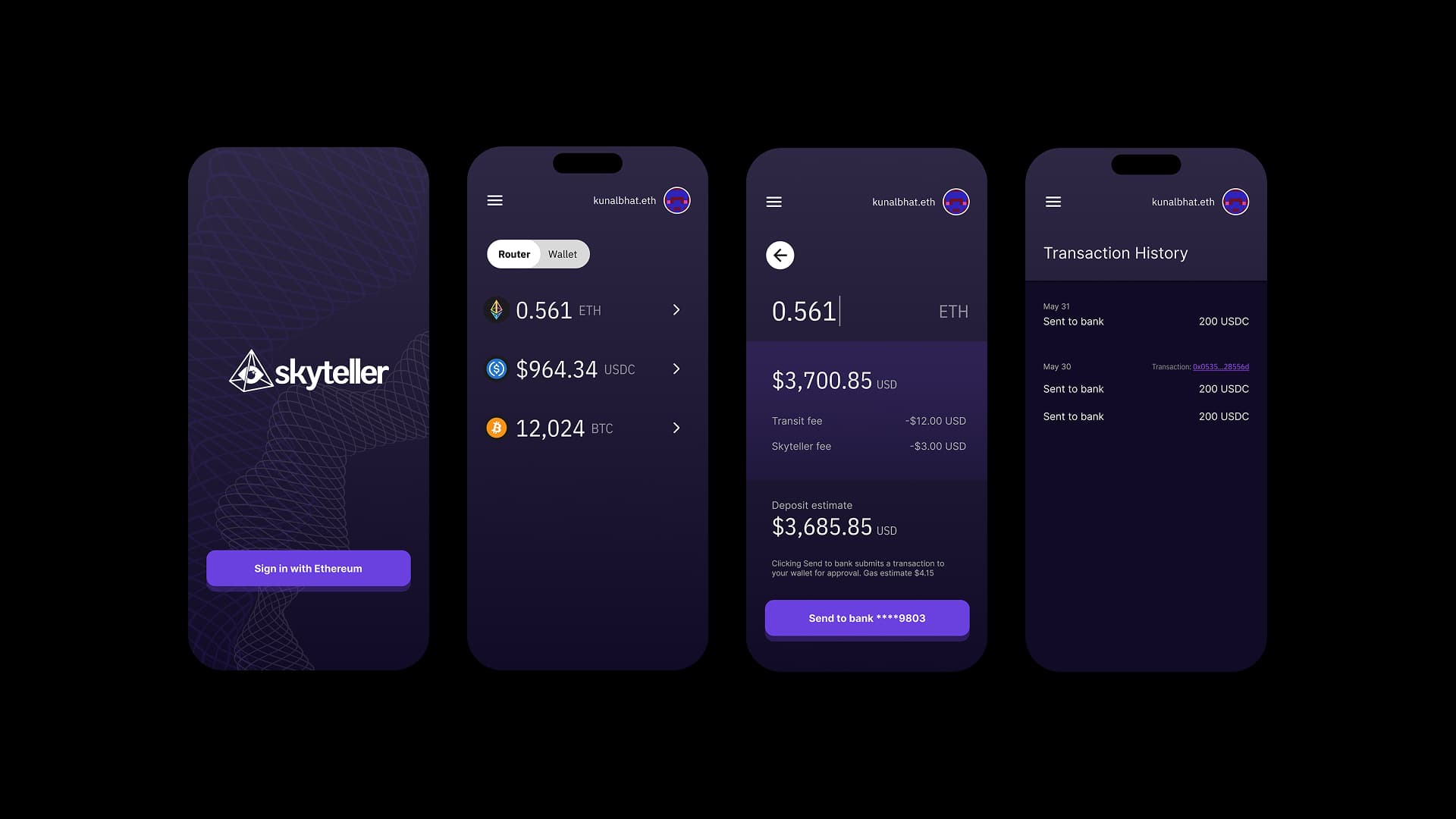

Skyteller started with a simple promise: turn crypto into cash in one click while keeping users in control of their funds. We built a bridge from self-custodial wallets to bank accounts that routed funds through a personalized on-chain contract and a compliant off-ramp partner.

Context

In 2023, buying crypto was getting easier, but turning it into “real” money still came with huge hurdles—both technical and experiential. Off-ramping required multiple tools, fees stacked quickly, and the UX was brittle. Exchanges could fail, wallets could be misused, and every hop added risk. For people earning income in crypto, the consequences were real. We wanted to make off-ramping simple, secure, and trustworthy. The product shipped as a responsive web app so merchants could complete the full flow on both desktop and mobile.

This was a personal pivot for me: after PM-ing at PayPal, I stepped into a primarily engineering role. I focused on our React stack and web3 integrations while also designing the core user flows and leading the UX/UI direction.

Pivot: card program to off-ramp

We initially explored a debit card program, but it became clear that the foundational work needed for a card—identity, risk, and reliable funds movement—was the same work required to build a world-class off-ramp. We pivoted to the off-ramp first, treating it as the core primitive that would later unlock cards, bill pay, and other financial tools.

The card path also put too much of our roadmap in the hands of regulatory mandates tied to issuing through Lithic, which limited our control over timing and experience. The off-ramp gave us a clearer path to delivering value while we built the right compliance foundation.

Problem statement

Converting digital assets into fiat is tedious, risky, and costly. The question we anchored on: how might we empower crypto natives and the crypto-curious with a straightforward, secure path to funds out?

Goals

- Enable users to off-ramp quickly with clear, transparent transaction status.

- Deliver the smoothest onboarding experience in a crypto-enabled dApp.

- Build the foundation for future products like bill pay, P2P, and cards.

Impact

This product was less about traditional metrics and more about making something brand new—and truly hard to build—feel possible for everyday users. The impact was in proving the concept, reducing intimidation, and showing that off-ramping could be approachable without sacrificing trust.

These integrations represent the bets we made to stitch together a credible, end-to-end experience across wallets, identity, and money movement.

RainbowKit

Wallet connection UI

wagmi

Web3 hooks + providers

Plaid

Bank account linking

Persona

KYC verification

Lithic

Card issuing rails

Bridge

Off-ramp settlement

Solution

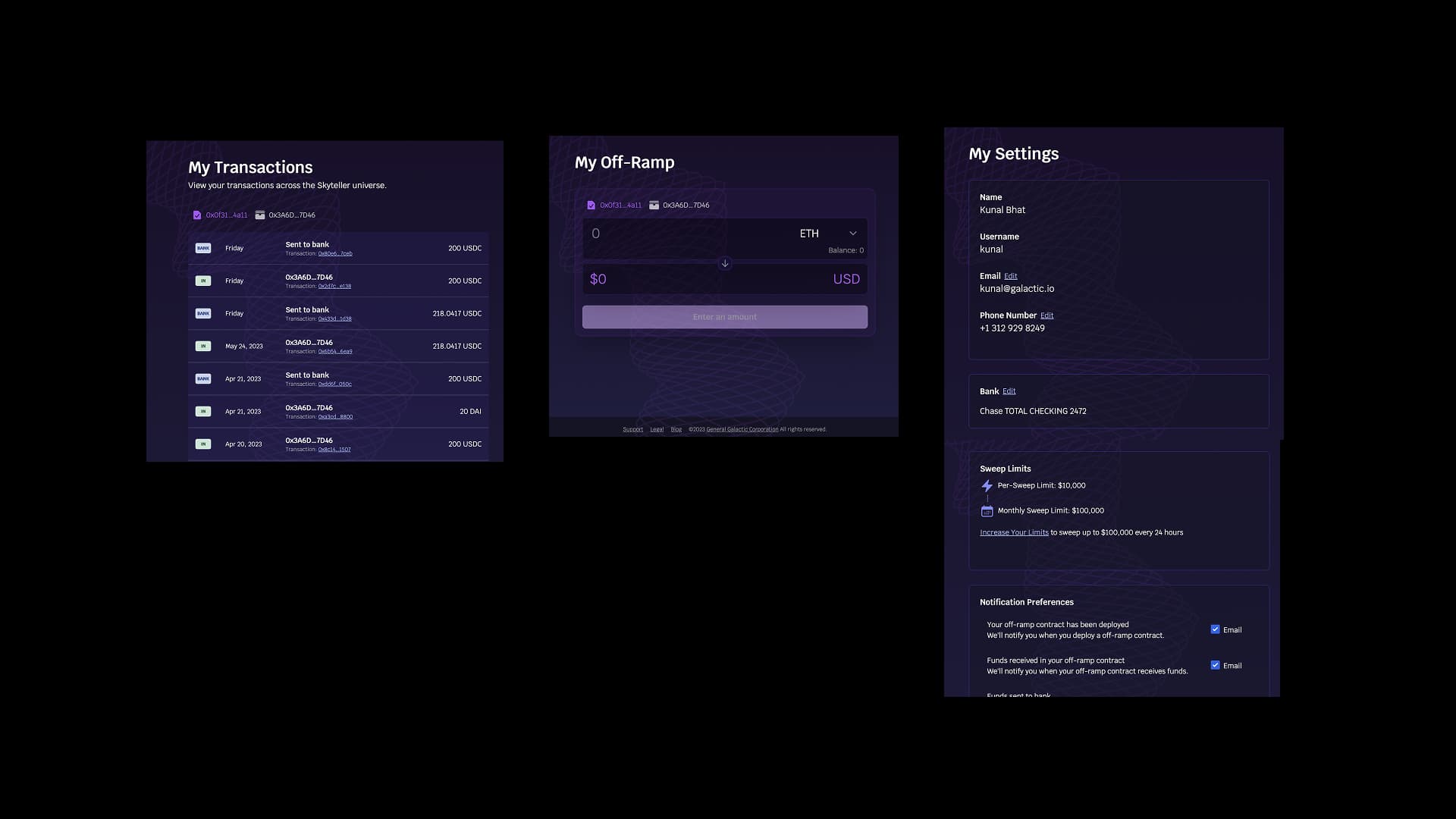

We created a personalized router contract that gave every user an on-chain address tied to their bank account. Funds could be sent from a connected wallet, a third-party wallet, or a personalized “Pay me” URL, then swapped and routed to fiat.

Early interface

How the flow worked

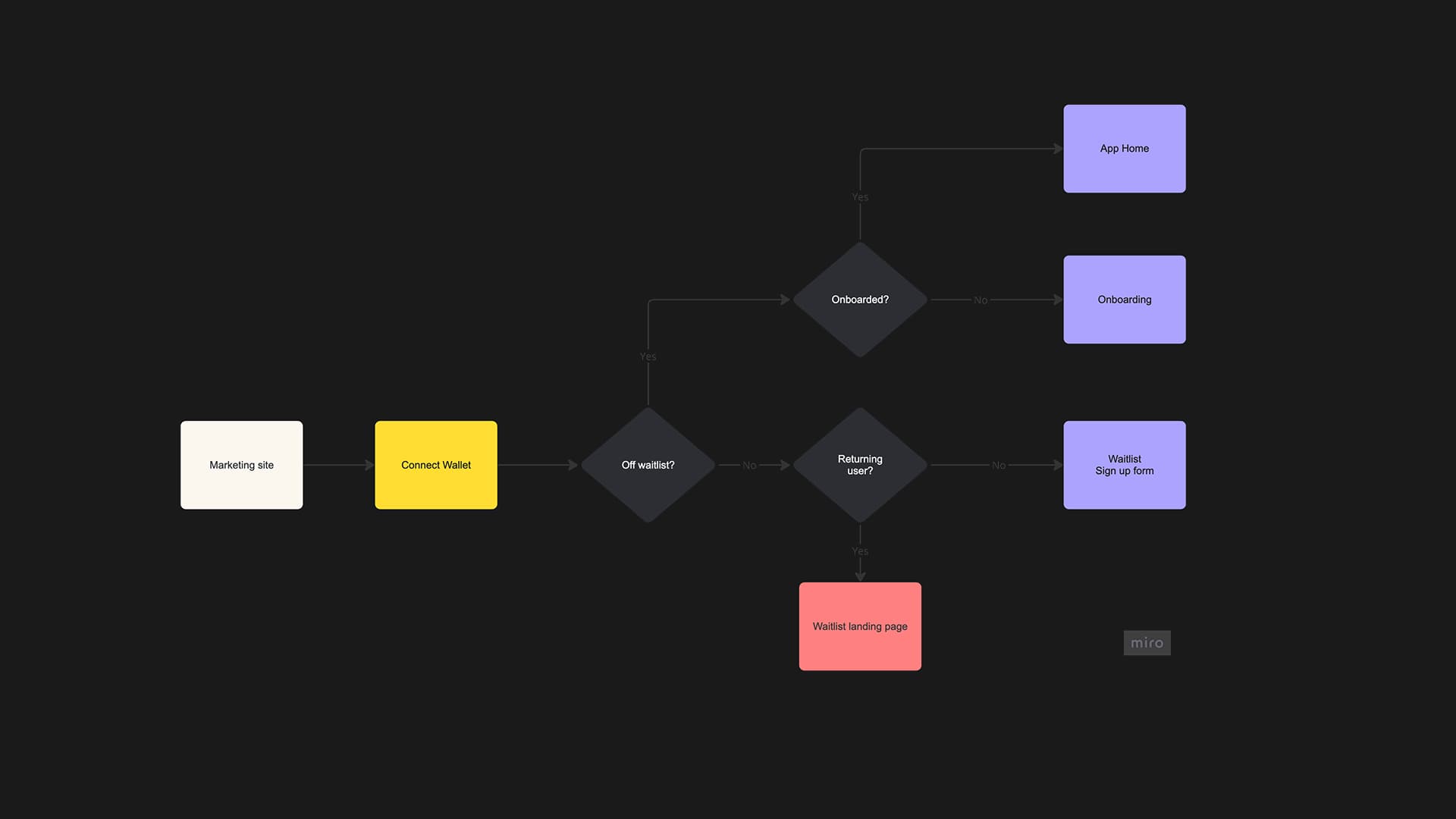

Users connected a non-custodial wallet and a bank account via Plaid. When a transfer was initiated, funds were swapped into USDC, sent to an off-ramp partner, converted to USD, and routed to the connected bank account. A transaction timeline kept users informed at each step.

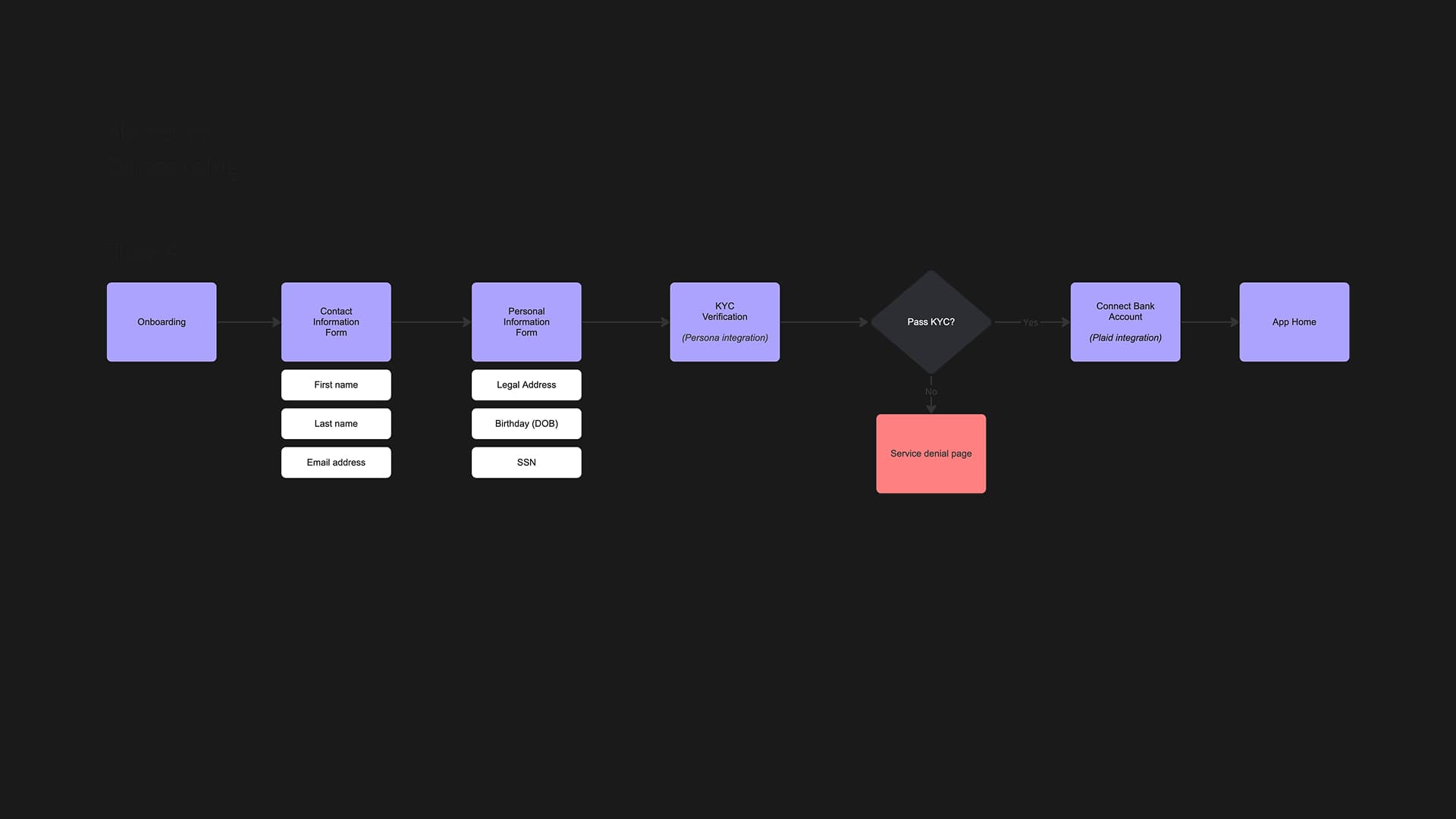

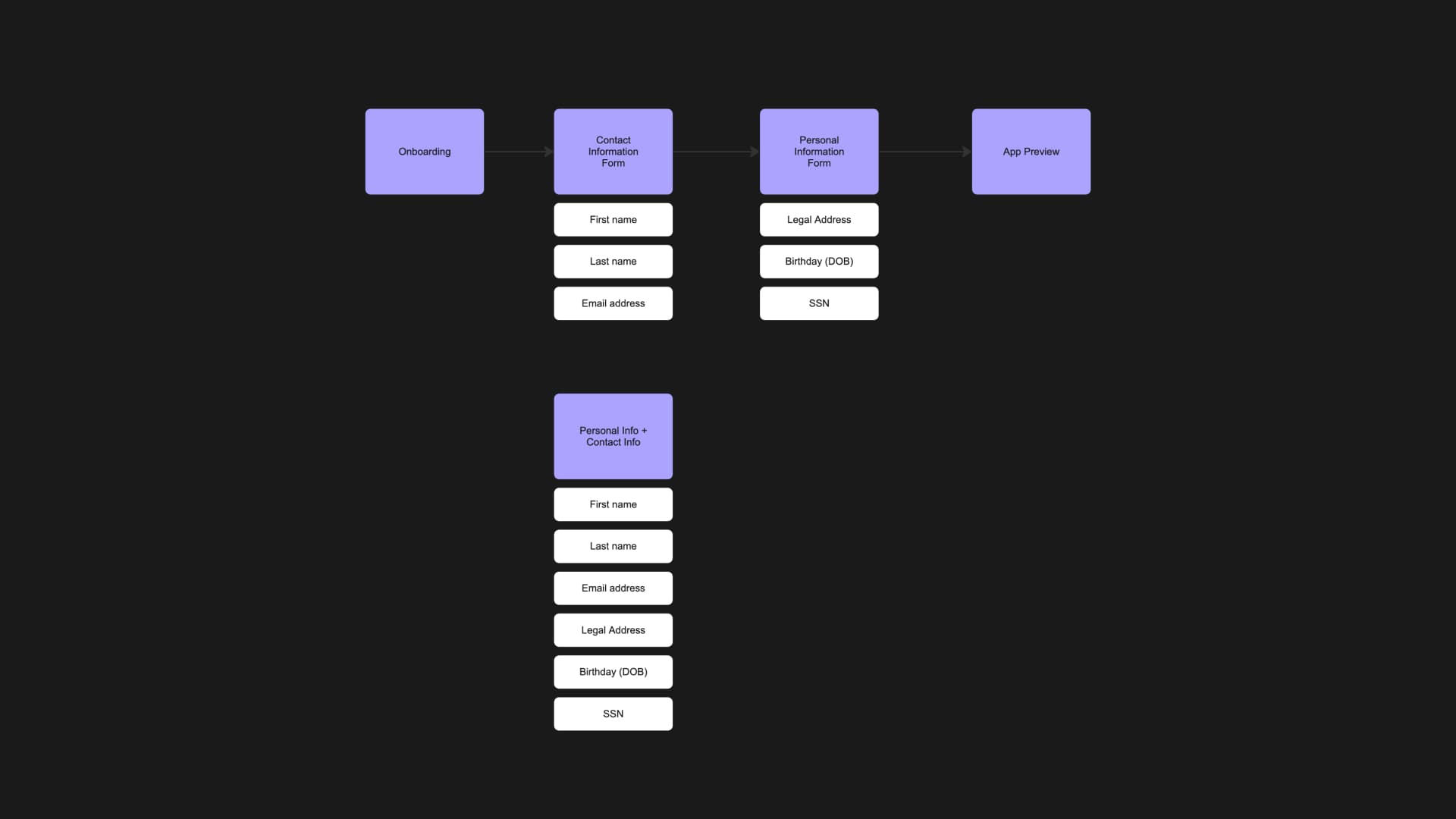

Onboarding and trust

Because the product handled real money, trust was critical. We designed onboarding around KYC verification, clear risk assessments, and explicit consent for wallet and bank connections.

Architecture highlights

- Next.js front end with wagmi and RainbowKit for wallets.

- Firebase + Cloud Functions for event processing.

- Plaid for bank connectivity, Persona for KYC, and Bridge for off-ramp settlement.

- Lithic for debit card issuing exploration.

- A homegrown chain watcher for real-time risk assessment.

Technical challenges

Much of the web3 stack was early and unstable. Wallet adapters, authentication flows like Sign-In With Ethereum, and chain providers lacked consistent documentation and had edge cases that surfaced only in production-like testing. We built additional abstraction layers, added defensive UI states, and wrote fallback flows to handle wallet disconnects, signature failures, and session persistence across devices.

Rollout approach

We started with a waitlist and friends-and-family cohorts, then expanded access once the onboarding and off-ramp flows were stable. This staged rollout helped us tune risk thresholds, support workflows, and user communication.

Conclusion

By summer 2023, the crypto downturn and fundraising headwinds left us without a sustainable path forward. We made the hard, responsible call to shut down Galactic and sunset the product only weeks after launch. The work itself was deeply rewarding: cutting-edge, technically demanding, and full of new paradigms. From a UX perspective, the challenge was earning trust and making unfamiliar flows feel safe and familiar—an experience I learned a lot from, even if the timing worked against us.